Moscow Exchange stocks that could soar if a ceasefire is reached and U.S. sanctions are lifted

Posted on Mon 11 August 2025 in Finance

Reader Question

"Which Russian stocks are likely to rise the most if a ceasefire is reached in Ukraine and the U.S. lifts sanctions? List their MOEX tickers and potential upside."

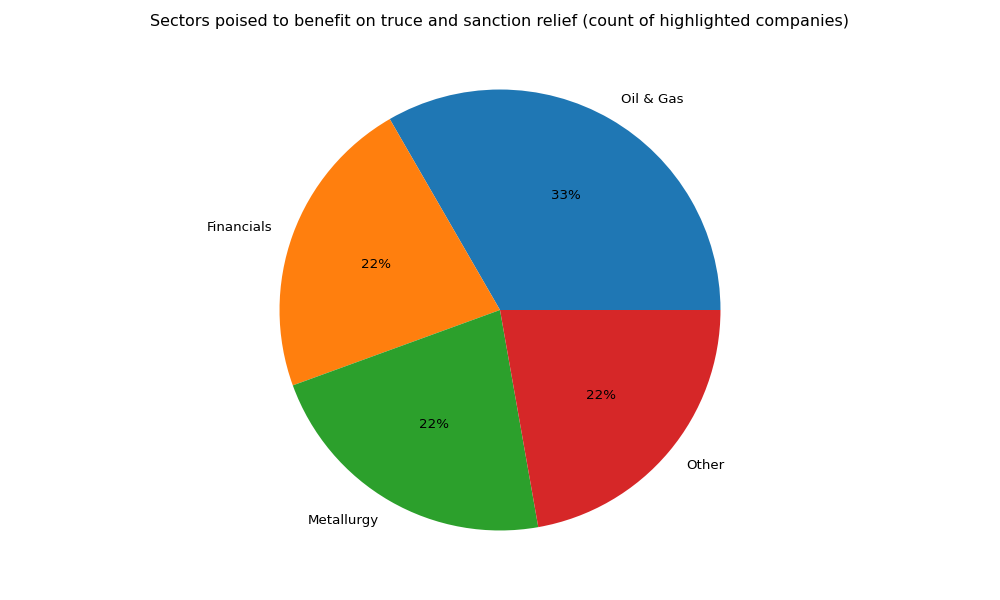

If a ceasefire is reached in the Ukraine conflict and U.S. sanctions are lifted, Russian companies listed on the Moscow Exchange could see a sharp re-rating. The biggest beneficiaries would likely come from oil and gas, financials, and metals, with select opportunities elsewhere. Below is a look at potential winners and their tickers.

1. Oil and gas

Energy names would be among the prime beneficiaries of sanctions relief and a better geopolitical backdrop, thanks to restored access to international markets and technology, plus greater export capacity.

Gazprom (GAZP)

- Ticker: GAZP

- Description: Gazprom is a transnational energy company with a dominant position in natural gas.

- Upside potential: Analysts view Gazprom as one of the market’s more attractive ideas, with potential to outperform the MOEX index Source.

- Why it could rise:

- Reopening access to European markets and potential share gains there.

- Possibility of reaching an agreement on the Power of Siberia 2 project.

- Further development of gas production and transportation projects Source.

Rosneft (ROSN)

- Ticker: ROSN

- Description: Rosneft is one of the world’s largest oil companies, with substantial oil and gas reserves.

- Upside potential: Sanctions relief could restore access to international markets, lifting revenue and the share price.

- Why it could rise:

- Renewed access to Western technology for complex field development.

- Higher exports of crude and refined products Source.

Novatek (NVTK)

- Ticker: NVTK

- Description: Novatek is Russia’s leading producer of liquefied natural gas (LNG).

- Upside potential: The company could complete major projects such as Arctic LNG 2 and strengthen its position in global LNG Source.

- Why it could rise:

- Growing LNG demand amid the energy transition.

- Ability to attract foreign investment Source.

2. Financials

Banks would benefit from a better investment climate and access to global capital markets, enabling balance sheet growth and higher activity.

Sberbank (SBER)

- Ticker: SBER

- Description: Sberbank is Russia’s largest bank, with a sizable loan book and a low cost base.

- Upside potential: Analysts rank Sber among the market’s most attractive names with strong upside Source.

- Why it could rise:

- Restored access to international capital markets.

- Increased foreign investor inflows to Russian assets.

- Dominant domestic market position Source.

VTB (VTBR)

- Ticker: VTBR

- Description: VTB is one of Russia’s largest banks and a key player in the financial sector.

- Upside potential: Normalizing access to international markets and lower geopolitical risk could improve the investment case Source.

- Why it could rise:

- Restart of international operations.

- Stronger investment flows into Russian markets Source.

3. Metals and mining

Metals producers stand to benefit if exports normalize and production ramps up after sanctions are eased.

Severstal (CHMF)

- Ticker: CHMF

- Description: Severstal is one of Russia’s largest steelmakers with meaningful export capacity.

- Upside potential: Regained access to international markets and fewer sanctions constraints could lift exports and revenue Source.

- Why it could rise:

- Higher shipments to international customers.

- Fewer logistics and financing bottlenecks Source.

TMK (TMK)

- Ticker: TMK

- Description: TMK is a leading Russian producer of pipes for the oil and gas industry.

- Upside potential: Sanctions relief could boost exports and stimulate demand for its products Source.

- Why it could rise:

- Restored deliveries to international markets.

- Higher demand for pipes in oil and gas projects Source.

4. Other names

Select companies outside the above sectors could also benefit if the macro backdrop improves.

Lukoil (LKOH)

- Ticker: LKOH

- Description: Lukoil is one of Russia’s largest oil companies, with substantial reserves.

- Upside potential: It could benefit from a better geopolitical climate, though performance will still hinge on oil and gas prices Source.

- Why it could rise:

- Higher exports of crude and refined products.

- Lower geopolitical risk premia Source.

Unipro (UNIP)

- Ticker: UNIP

- Description: Unipro is a Russian power generation company.

- Upside potential: Revenue growth could remain steady on tariff indexation and renewed access to international markets Source.

- Why it could rise:

- Stable tariffs and government support.

- Potential to attract foreign investment Source.

Risks and swing factors

While a ceasefire and sanctions relief would be tailwinds for Russian equities, key risks remain:

1. Fragile ceasefire: The geopolitical situation could stay unstable, weighing on the market Source.

2. Dependence on global trends: Outcomes hinge on policy decisions and broader macro conditions Source.

3. Commodity price risk: For names like Lukoil and Rosneft, oil and gas price volatility may cap upside Source.

Conclusion

If a ceasefire is reached and U.S. sanctions are lifted, Russian stocks on MOEX could re-rate meaningfully. The most likely winners include:

- Oil and gas: Gazprom (GAZP), Rosneft (ROSN), Novatek (NVTK).

- Financials: Sberbank (SBER), VTB (VTBR).

- Metals: Severstal (CHMF), TMK (TMK).

- Other: Lukoil (LKOH), Unipro (UNIP).

Their upside will depend on renewed access to international markets, fresh capital inflows, and macro stabilization. Investors should also account for the remaining geopolitical and global economic risks Source.

Research Statistics: - Websites Visited: 446 - Chunks Analyzed: 19,257 - Total Characters Read: 20,357,047